Chinese policy is unlikely to shift due to announced tariffs

US President Donald Trump’s announcement of an additional 10% tariff on imports from China was in line with our baseline expectation. But the immediacy of implementation, the blanket style of tariffs, and the inclusion of stronger language around retaliation in policy documents still add significant uncertainty to our forecasts.

What you will learn:

- Unlike announced tariffs on Canada and Mexico, we expect those on China to be permanent. Our modelling suggests that a10ppts tariff increase will subtract 40bps from China’s GDP, all else equal, and generate modest downward pressure on China’s inflation and currency. Onshore fiscal easing this year should help to offset the hit to China’s economy, but not entirely. We will therefore revise our 2025 GDP growth forecast for China modestly downwards in the upcoming forecast round.

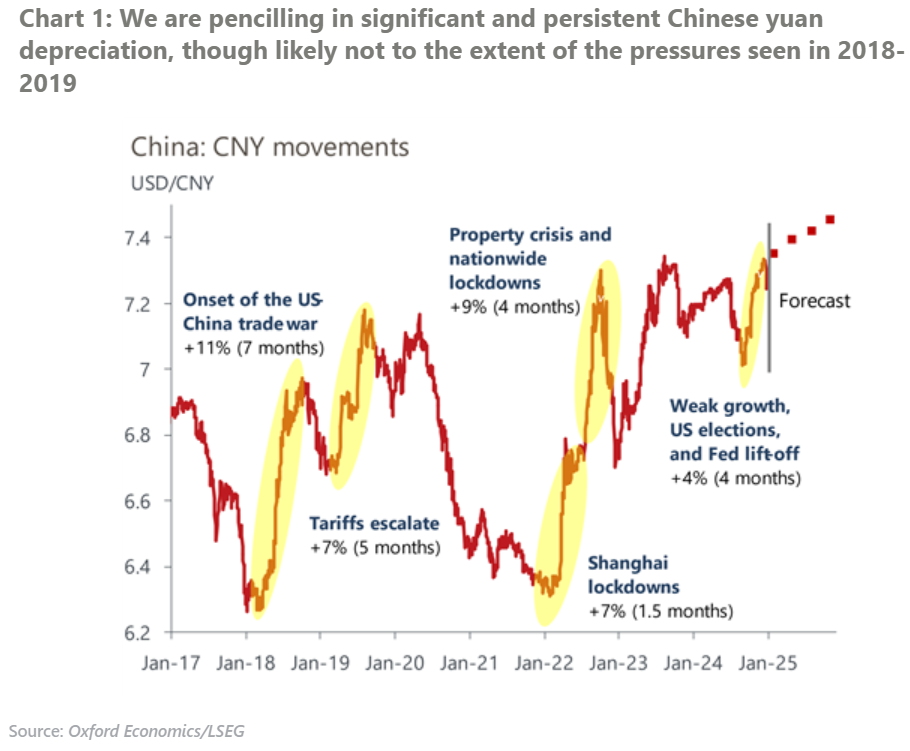

- The trade war is in the early stages, so the likelihood of further tariffs is high. As markets price in additional tariff uncertainty, the Chinese yuan is likely to come under continued depreciation pressure. We now expect the yuan spot price to move towards 7.5 this year, and risk to this forecast is skewed to the upside to the extent that Chinese policymakers lean on a weaker currency to offset the effects of higher tariffs.

- That said, our central assumptions for the Chinese economy in the near-to-medium term continue to be guided by its domestic struggles and the effectiveness of stimulus, not tariffs. Tariffs or not, the economy is headed towards a period of looser-for-longer policy settings if Beijing wants to maintain relative growth stability. We expect the government’s augmented fiscal deficit, our proxy for stimulus spending, to stay elevated at around 10% of GDP over the next three years.

Tags:

Related Posts

Post

Trade tracker – Tariff impacts continue to build

US tariff rates are climbing to levels not seen since the 1930s, with world trade expected to decline and inflation set to rise. What could this mean for global markets and economic growth?

Find Out More

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

US tariffs and the uneven impact across cities in Europe and Asia

The latest US tariffs are reshaping global trade patterns, hitting some cities harder than others. From Germany’s auto hubs to China’s electronics exporters, which regions will weather the storm and which will struggle?

Find Out More