Climate Risk Insurance Modelling for Australia’s Future

Oxford Economics Australia supported the Australian Prudential Regulation Authority (APRA) and the Council of Financial Regulators by delivering detailed economic modelling, regional income forecasts, and emissions-aligned climate scenario analysis to guide insurance affordability and resilience planning under climate transition risk.

Background: Understanding Stakeholder Expectations Amid Rising Climate Perils

Australia’s financial regulators required robust tools to assess how physical and transition climate risks under different emissions and policy pathways impact the insurance sector’s affordability and accessibility. With stakeholder expectations rising for ESG reporting, climate scenario analysis, and alignment with ASRS and GRI standards, regulators needed economic insights that go beyond generic reporting.

Challenge: Aligning Scenario Planning with Disclosure Requirements and Net Zero Goals

Climate scenario modelling must be precise, geographically granular, and grounded in recognised sustainability reporting standards. The challenge was to assess insurance sector vulnerabilities under two divergent scenarios:

- A Delayed Transition (net zero transition starting after 2030)

- Current Policies (no further mitigation beyond existing regulations)

This required integrating climate science, economic forecasting, and detailed regional data to meet evolving ESG reporting and stakeholder expectations.

Solution: Delivering ESG Reporting Tools through Climate Scenario Analysis and Income Forecasting

Oxford Economics Australia addressed these needs by delivering:

- Macroeconomic modelling across three scenarios (Delayed Transition, Current Policies, Counterfactual)

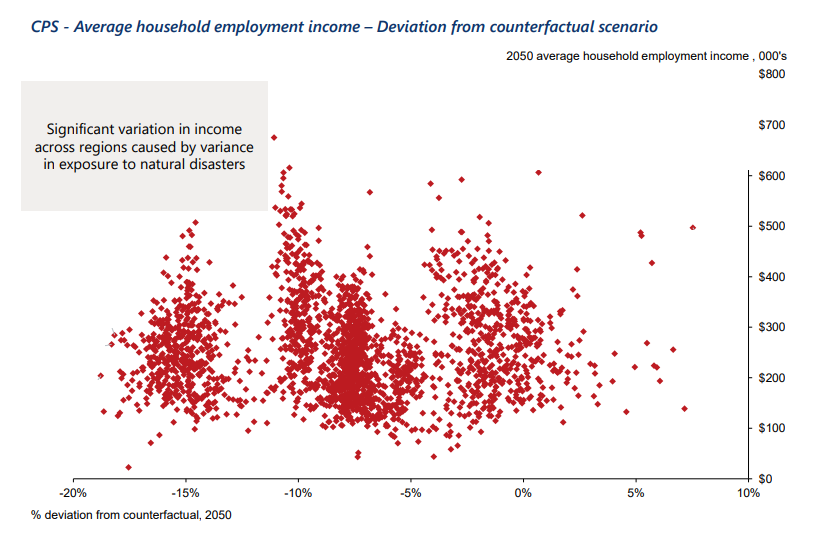

- Downscaled household income projections at national, state, and SA2 regional levels

- Sector-specific impacts for emissions-intensive industries (coal, livestock, manufacturing, agriculture)

- Integration of climate scenario analysis into GVA, inflation, employment, and insurance affordability projections

- Use of internationally recognised frameworks, including NGFS-aligned climate scenario narratives and tailored GRI-aligned sustainability reporting

Impact for the Customer (APRA & CFR):

- Informed policymaking on climate risks to insurance affordability

- Enabled alignment with global sustainability reporting standards (GRI, ASRS, SFDR)

- Provided granular, geographically relevant income data to assess reinsurance likelihood and access to insurance under worsening climate scenarios

- Supported transparency in stakeholder communication and climate disclosure requirements

The experts behind the research

Download Report Now

You might be interested in

Related Posts

Post

Overcoming Scope 3 data challenges for global supply chains

Major Australian corporates face a new reality. Not only is climate change here but so – as from the start of this year – are new sustainability reporting standards.

Find Out More

Post

Setting a 2035 emissions target is hard, but achieving it will be much harder

The Australian government is currently developing the 2035 greenhouse gas emissions target as part of its Nationally Determined Contribution (NDC) submission required by the Paris Agreement. Countries who signed onto the Paris Agreement are expected to set a 2035 NDC target before COP30, which is slated to be held next year.

Find Out More

Post

It’s a bumpy road but Australia’s 2030 climate target is within sight

Following hawkish comments from the Reserve Bank of Australia and a rise in monthly CPI indicator readings in the last two months, markets are pricing in a higher probability that the RBA will hike interest rates at its next meeting in August. We think this speculation is overblown.

Find Out More