Research Briefing

| Apr 17, 2024

Cross Asset: Closing our tactical long on gold, but we’re still bullish

The strength of the recent gold price rally has defied even our already bullish expectations and we think prices are vulnerable to a price consolidation in the short term. As a result, we close out our tactical long position on gold that we opened in October last year.

What you will learn:

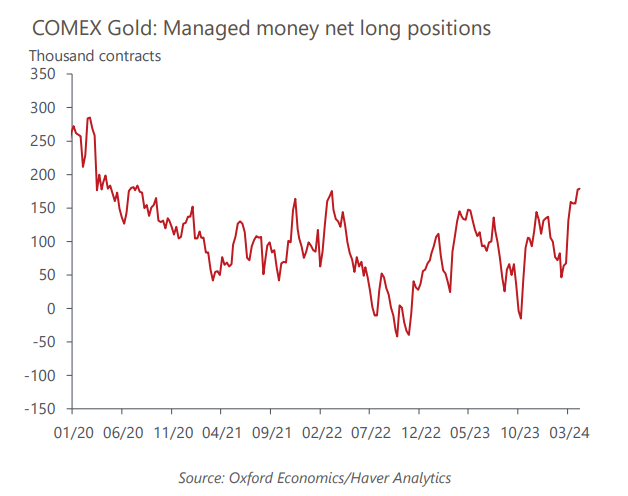

- Strong structural demand forces have created a very supportive environment for gold, with emerging market central banks, Chinese consumers, and money managers having been very supportive recently.

- But with the US economy proving resilient and real rates making new highs, the rally will likely run out of steam and we see prices consolidating in the short term.

- Still, we remain bullish strategically as we continue to see strong fundamentals ahead, with EM central bank buying and strong demand from Chinese consumers that is far from moderating. We think only a combination of yields falling and a weaker dollar or much higher retail participation would be needed to push the next gold price leg higher.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Why bond yields are rising again and why it matters

The rise in bond yields reflects fiscal concerns, higher risk premia, shifting investor preferences, and idiosyncratic factors.

Read more: Why bond yields are rising again and why it matters

Indirect climate risk in financial analysis

Climate and other sustainability challenges can affect the finance sector and have a material impact on returns to capital.

Read more: Indirect climate risk in financial analysis

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Read more: Strategy Key Themes 2025: Opportunities amid heightened uncertainty

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers[autopilot_shortcode]