Easing financial conditions offer CRE some respite

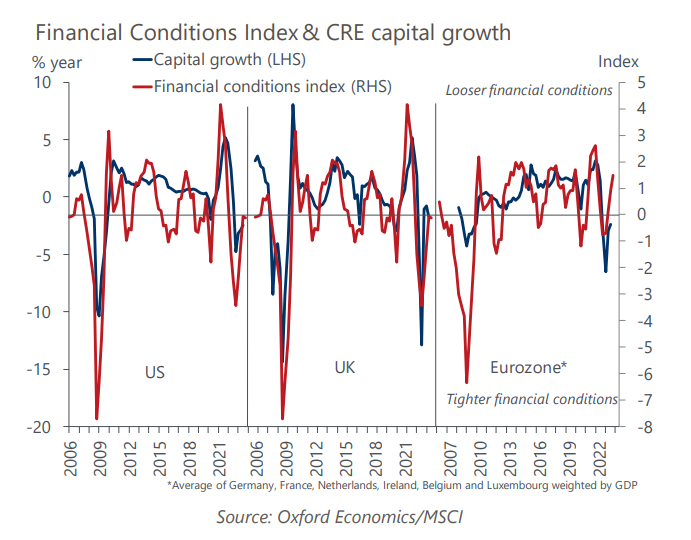

Our measure of financial conditions has become less restrictive in the US and started to loosen in the eurozone and the UK, reflecting investors’ expectations that interest rates have peaked. This should aid the outlook for commercial real estate (CRE) on the margins, although the scale of past rate hikes, sluggish economies, and structural headwinds mean the sector still confronts challenging fundamentals.

What you will learn:

- The evidence suggests that movements in financial conditions are an important driver of CRE prices, reflecting the sector’s use of bank lending and, indirectly, the influence of financial conditions on economic activity and demand for commercial property.

- The next move in interest rates by the Fed, the European Central Bank, and the Bank of England will likely be down, a particular positive for CRE given the importance of floating-rate debt and the scale of refinancing needs over the next few years. Among major economies, our measure of financial conditions has loosened the most in the eurozone, suggesting CRE upside for the bloc.

- However, CRE is confronted with pressures unrelated to financial variables, such as higher labour and material costs and, in the office sector, structurally lower occupancy rates. Hence, recent favourable moves in financial conditions will go only so far in supporting the asset class.

Tags:

Related Services

Post

Office rents entering growth cycle in Australia

CBD office markets in Australia face high vacancy rates, but a supply shortage is expected to drive a strong rent recovery. Effective rents are forecast to rise sharply up to 108% in some cities by FY2035 as vacancy rates fall and incentives normalise.

Find Out More

Post

Housing policy outlook clears after Federal Election in Australia

Saturday's Federal Election decisively delivered a second term for the Albanese government, clearing up the policy outlook.

Find Out More

Post

New indices offer insights into real estate sentiment

Our new suite of sentiment indices show global CRE sentiment has deteriorated significantly this year.

Find Out More