European defence spending surge: which sectors will benefit?

Both US and European manufacturers will benefit from the surge in European defence equipment investment.

Russia’s ongoing invasion of Ukraine, political pressure from the US, and a more fragmented geopolitical landscape are prompting European policymakers to significantly ramp up defence spending. Though there is uncertainty over how the spending will be allocated, a sizeable share of it—around two-thirds in our view—will go towards defence equipment, in order to rebuild depleted stocks of aircraft, ammunition, weaponry and ships.

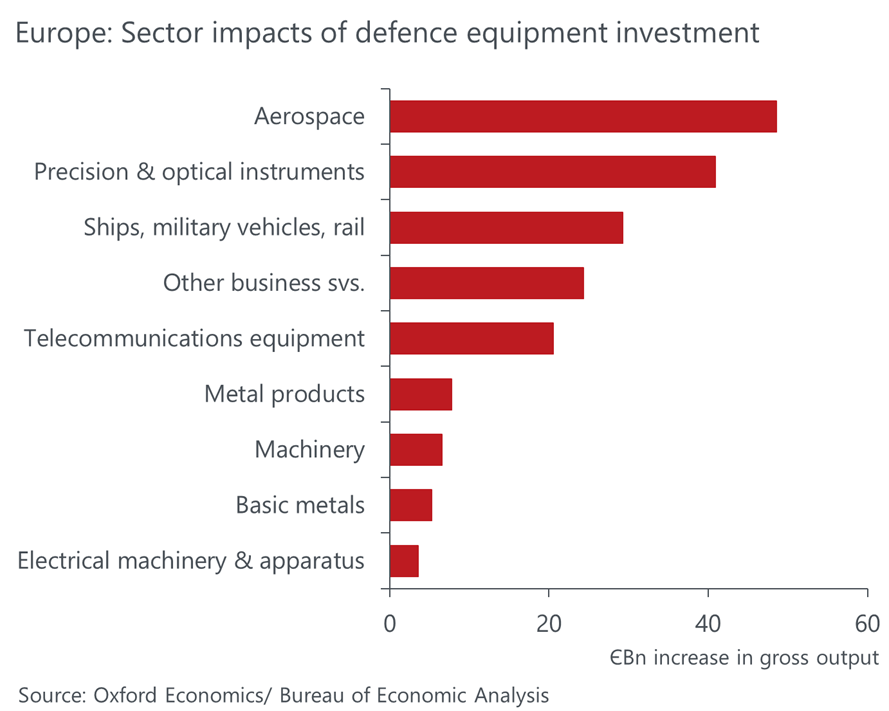

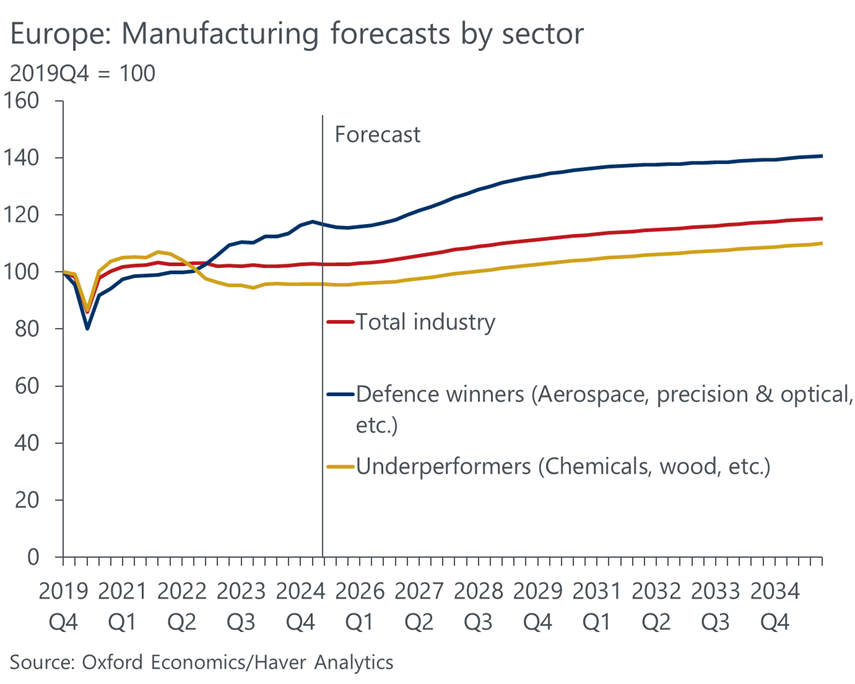

This surge in investment on the horizon is set to boost prospects for the struggling European manufacturing sector, which has experienced a prolonged period of declining growth and competitiveness. Capital intensive sectors within transport and electronics, for instance aerospace, are set to boost production considerably.

But how quickly and by how much European manufacturing will increase is uncertain. The EU has acknowledged that European defence capacity will struggle to scale up quickly enough to fully meet the rising demand for equipment in the volume and speed required.

Indeed, European investment in defence-related manufacturing stagnated substantially between the early 1990s and 2022, as defence spending was de-prioritised in an environment of relative security—the so-called “peace dividend”.

Since the Russian invasion of Ukraine in 2022, investment in bolstering capacity has surged, primarily to supply Ukraine’s war efforts. However, the speed at which demand has shot up has exceeded capacity, leading to a substantial accumulation of backlogs in defence-related sectors. While granular data on defence are hard to come by, a detailed IISS review suggests European capacity reductions have been particularly pronounced in rocket artillery, armoured fighting vehicles, naval ships, and military aircraft.

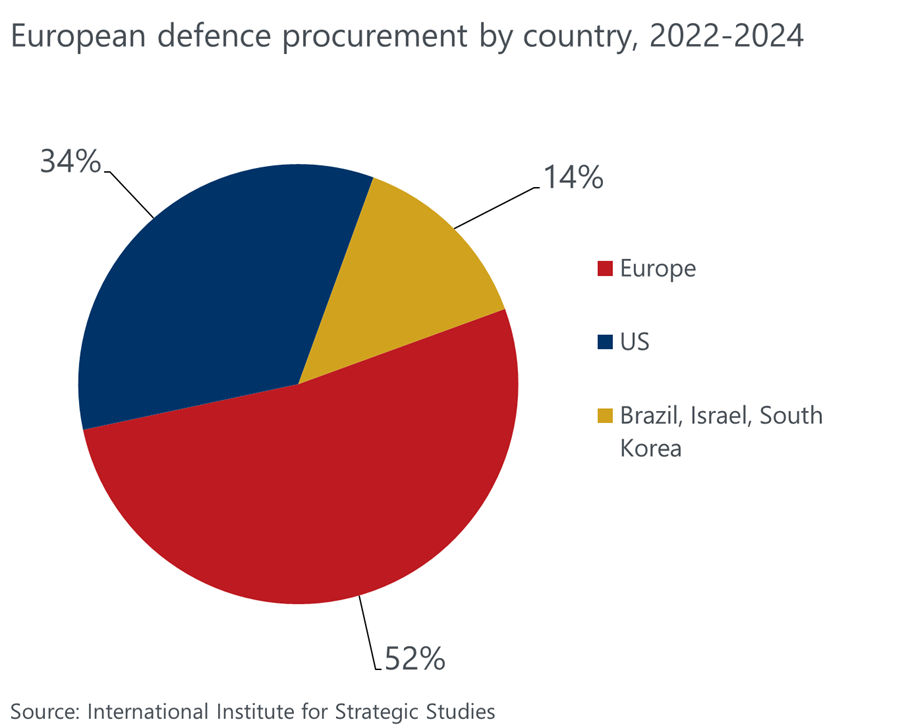

In the near term, this means that there will be a relatively high reliance on imports if policymakers want to increase supplies of defence equipment in a swift and cost-effective way, which will dilute the gains to domestic industry. In line with recent data, we assume around 50% of the supplies will come from abroad, mainly the US.

Transport and electronics will benefit the most from the defence spending surge

Both US and European manufacturers will therefore benefit from the surge in European defence equipment investment. But how will the gains be spread across the spectrum of manufacturing sectors?

Our modelling suggests the main beneficiaries of the spending will be a highly concentrated subset of capital-intensive subsectors, mainly in transport and electronics. There will also be some positive spillovers for upstream sectors that supply inputs for defence equipment makers, including basic metals and metal products, as well as service sectors like computer systems design and engineering.

Unlock exclusive economic and business insights—sign up for our newsletter today

Subscribe

Given the sectorally concentrated nature of the spending, the defence investment will not be hugely beneficial to many of the sectors that have underperformed in recent years under the weight of rising competition from China, and elevated energy prices. These include wood, chemicals, rubber and plastics, and non-metallic minerals. Our forecasts show a widening divergence in Europe between these underperformers and the “defence winners” over the next five years.

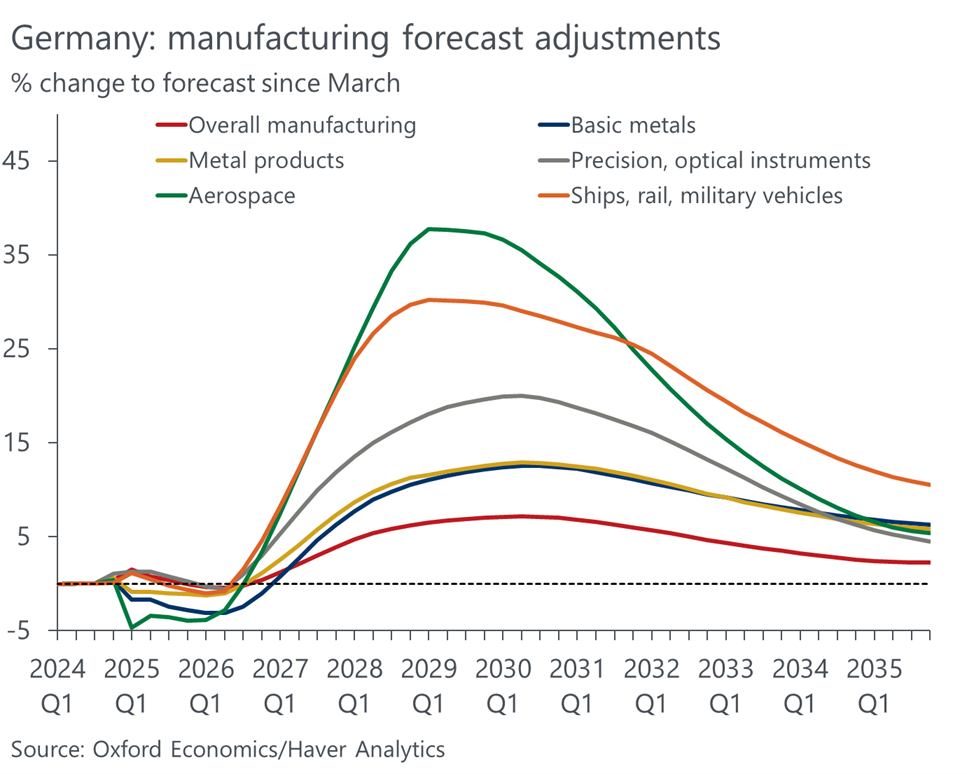

On net, our manufacturing forecasts have been upgraded by 1.2% by 2030 relative to our March forecasts. But on balance, we think risks to our output forecasts are firmly to the downside. This is because there are several major hurdles to quickly scaling up EU manufacturing capacity:

- The industry will need to attract and train a significant pool of new workers to expand capacity, especially for high-tech equipment and systems.

- Reducing reliance on foreign defence systems will also require catching up to US technology levels, which will require a major uplift in R&D spend.

- Firms in the supply chain will need a healthy stream of long-term orders to get the right signals to significantly ramp up investment.

- There will be competition with other sectors for certain critical inputs (e.g., semiconductors), creating the potential for production bottlenecks.

- The highly fragmented nature of the European defence industry limits its ability to produce at a large scale at present.

Regardless of the exact timings, as European industrial defence capacity is built up again, the proportion of defence spending going to European manufacturers should rise over time. As more of the spending goes to the domestic suppliers, the economic returns to the European economy will increase.

However, our analysis suggests the benefits will remain sectorally concentrated. Thus, we are sceptical that the defence-driven manufacturing renaissance will be a panacea for a broad-based European industrial renewal.

Would like to learn more about the impacts of increased defence spending in Europe?

Join Sean Metcalfe, the author of this blog, along with our experts team for an insightful webinar, as they dive deeper into the implications at the national, sectoral and regional levels.

Subscribe to our newsletters

Tags:

Related Reports

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Africa: A continent besieged along old fault lines

Africa has, once again, taken centre stage as countries vie for the top spot. The playing field has shifted slightly, and the rules of engagement have moved more toward the economic arena. In this Research Briefing, we explore the economic and political ties between Africa and China, the US, Europe and Russia as the continent navigates the new multi-polar world order.

Find Out More

Last-minute trade deal with the US leaves Eurozone outlook unchanged

We don't plan material changes to our Eurozone baseline forecast of 1.1% GDP growth this year and 0.8% in 2026 in response to the EU-US trade deal.

Find Out More