How politics could affect APAC economics in a busy 2024 – a primer

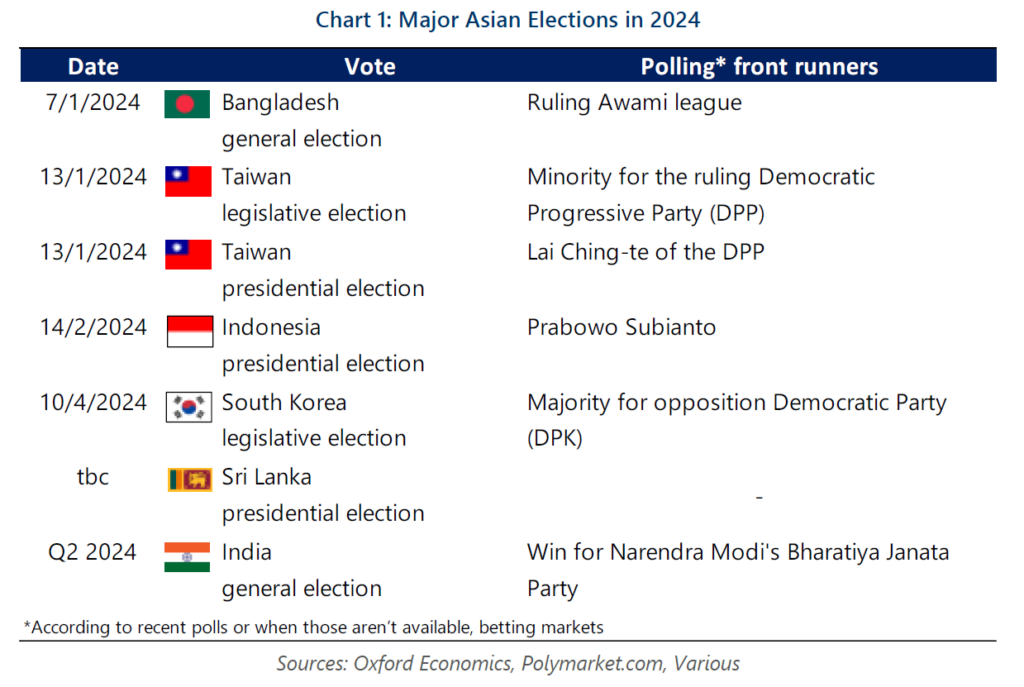

In this report, we present some preliminary research on how politics could affect APAC economics in a busy 2024. Our view is that the flurry of elections across Asia this year generally do not look like high-risk events for investors.

What you will learn:

- General elections in Bangladesh on January 7 are raising questions around election fairness, which risks antagonising the governments of key export markets. Bangladesh depends on exports to drive its low-wage manufacturing economy.

- Indonesia will vote for a new president on 14 February. Policy continuity with the outgoing president, Joko Widodo, is also likely to be maintained, though victory for the third-polling candidate, Anies Baswedan, could mean a bigger change in direction.

- Elections in India will take place over several weeks during April-May 2024. The incumbent Bharatiya Janata Party (BJP) and its leader Prime Minister Narendra Modi are front runners in the current polls. We assume continuity in overall economic policy, although we could see a bump in fiscal spending early this year in the run up to the polls.

Tags:

Related Posts

Post

US tariffs and the uneven impact across cities in Europe and Asia

The latest US tariffs are reshaping global trade patterns, hitting some cities harder than others. From Germany’s auto hubs to China’s electronics exporters, which regions will weather the storm and which will struggle?

Find Out More

Post

Japanification risk – down, but not out

Our updated analysis shows that the risk of 'Japanification' – a lengthy period of low growth and low inflation or deflation – has increased in Asian economies like China but declined in Europe. However, some of the changes may not be permanent. Economies are still settling down after the upheavals of the pandemic and some key underlying drivers of Japanification remain in place.

Find Out More