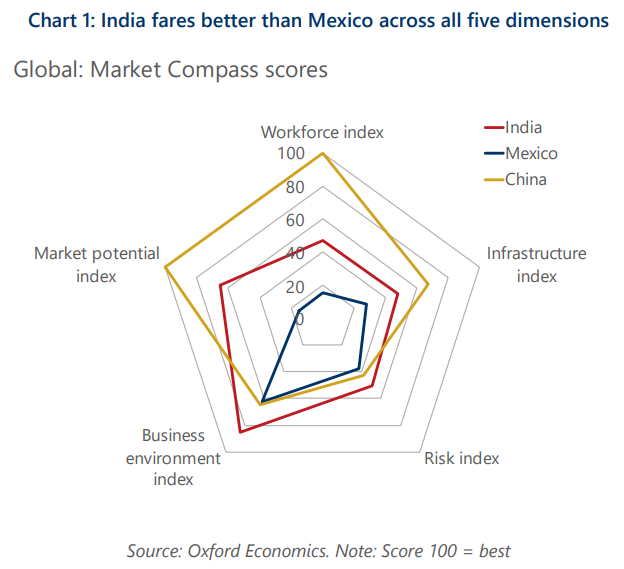

India has an edge over Mexico, but is not the next China

Our Market Compass tool confirms that there is no single “next China”, capable of replicating its distinct advantages as a global manufacturing hub, including its big domestic market, large and skilled labour force, and infrastructure quality. However, other countries can offer compelling propositions as alternative manufacturing hubs for companies looking to diversify their production footprint and reduce their China exposure.

What you will learn:

- Our tool suggests India is a strong contender, as it is third overall in our ranking of manufacturing attractiveness thanks to its macroeconomic stability, abundant labour, and large domestic market. Holding India back is its low productivity per worker and poor education levels, but it still is the top-scoring emerging market.

- Mexico recently replaced China as the US’s biggest trade partner and is often seen as a key winner in the nearshoring trend. However, it only ranks 36th out of 41 countries in the Market Compass given its greater exposure to risk scenarios such as higher-for-longer rates in the US, its poor security environment, and depleted capital stock.

- Companies focused on accessing the US market, not concerned with FX volatility, and with the ability to offset security and labour costs may prefer Mexico. Alternatively, India may be a better fit for firms looking for low labour costs and relative macro stability.

Tags:

Related Posts

Post

Five lessons for businesses navigating tariffs and trade turmoil

In a rapidly evolving global trade environment, businesses must stay ahead of changing tariffs and regulatory demands. Our latest blog offers practical guidance on navigating tariffs, understanding key trade strategies, and leveraging accurate HS code classifications to optimize your supply chain. Explore essential insights that will help your business manage trade uncertainty, ensure compliance, and unlock new growth opportunities.

Find Out More

Post

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Post

Tariffs 101: What are they and how do they work?

Tariffs are taxes imposed by a government on goods and services imported from other countries. Think of tariff like an extra cost added to foreign products when they enter the country. They’re usually a percentage of the price of the goods, making imported items more expensive compared to domestically produced good

Find Out More