Japan expects mixed impacts from Trump’s second presidency

We’ve adopted our “limited Trump scenario” as our baseline forecast for Japan. We now assume that the US will impose targeted tariffs on Japan’s exports, among several other economies. We think these measures will have a limited impact on overall growth, but globally higher trade barriers are likely to hit Japanese manufacturers’ profitability and financial markets. In addition, there is a non-negligible risk that Trump could implement even stricter tariffs.

What you will learn:

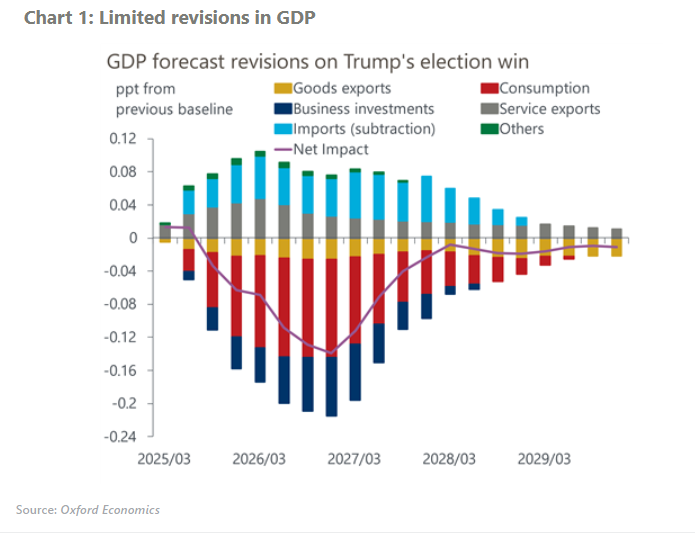

- Given Japan’s sizeable trade surplus against the US, we assume that the US will impose 10% tariffs on Japanese autos and base metals from 2026. The direct impact from additional tariffs on Japan’s exports will be limited. That said, we are revising down our export outlook for Japan given weaker capital goods demands ahead, though it will be partially offset by a stronger US economy supported by looser fiscal policy.

- In addition, we are downgrading our near-term projections for domestic demand. Businesses are likely to hold back capex activities amid high economic policy uncertainty. We think that policy uncertainty in the US matters as much as domestic policy for business investment decisions in Japan. Weaker household real income gains will limit consumption.

- Under our less likely “global trade war” scenario, the economy would suffer from higher tariffs, weaker global demand, and further yen depreciation. Also, recently announced 25% tariffs on Canada and Mexico, if realised, could hit the auto sector as they have invested heavily in Mexico.

For more insights on the 2024 US Presidential Election, click here.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More