Japan inflation to rise to 1.8%, but downside risks are high

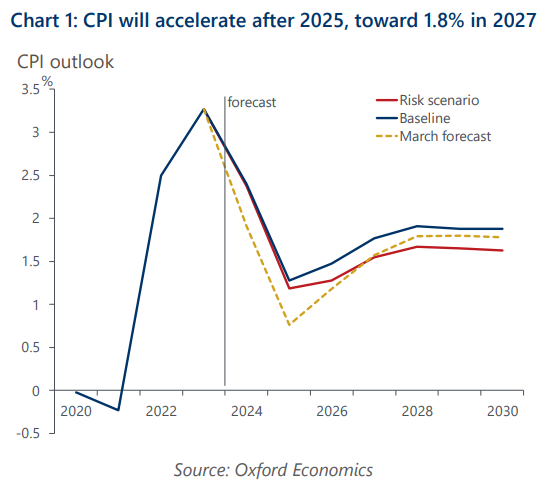

Reflecting a surprisingly strong Spring Negotiation result and weaker yen assumption, we have upgraded our baseline wage and inflation forecasts. We now project higher wage settlements will push inflation towards 1.8% by 2027. Uncertainty is high, however.

What you will learn:

- We anticipate the final outcome of the Spring Negotiation this year will likely be a wage rise of around 4.5% or more – much higher than last year’s 3.6%. We upgraded our wage projections for the next few years to reflect more aggressive wage-setting behaviour by top-tier firms.

- The main downside risk to our outlook is the sustainability of wage increases by SMEs. Another downside risk is disappointing demand growth, which will constrain pricing power.

- In our downside scenario, which assumes that these inter-related downside risks materialise, we project the CPI inflation rate would stabilise at 1.6% in 2027.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More