Japan’s BoJ rushed a rate hike without waiting for evidence

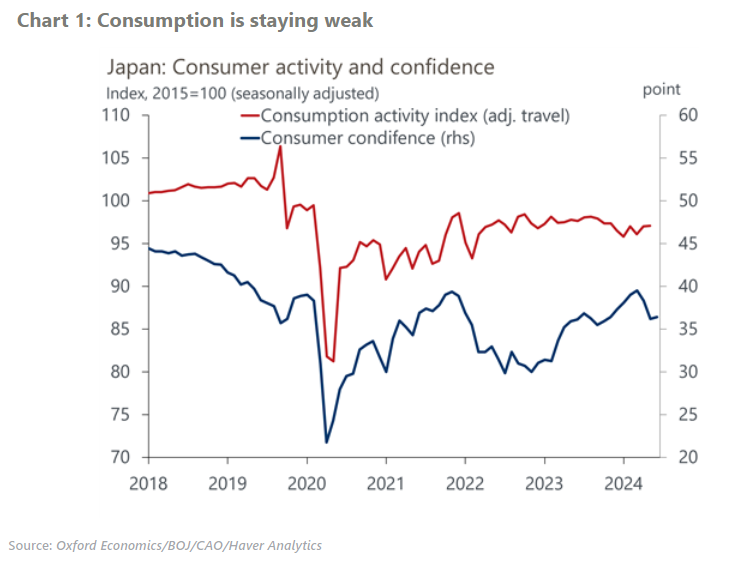

At Wednesday’s policy meeting, the Bank of Japan (BoJ) raised the policy rate to 0.25% without clear evidence of wage-driven inflation in wage and consumption data. Although CPI has stayed above 2%, the core-core CPI (excluding energy and fresh foods) has been easing.

What you will learn:

- The BoJ argued that recent data confirmed that the economy is on track for achieving the 2% inflation target as projected. The bank stressed that moves to raise wages “have been spreading across regions, industries, and firm sizes.”

- The BoJ revealed its plan for reducing JGB purchases which was in line with our projection. The bank will reduce monthly JGB purchases by ¥0.4trn every quarter from the current ¥6trn to reach ¥3trn in 1Q of 2026. Despite the substantial reduction in purchases, it will only reduce the BoJ’s JGB holdings by 7% and the share in outstanding JGBs to 45% from 48% by the end of FY2025.

- The statement said that “given that real interest rates are at significantly low levels, if the outlook in the July Outlook Report will be realized, the Bank will accordingly continue to raise the policy interest rate.” Based on this more hawkish policy reaction function, we will revisit our current projection to examine a chance of an earlier rate hike before spring next year.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More