Japan’s industry nearing the trough, with high tech leading the way

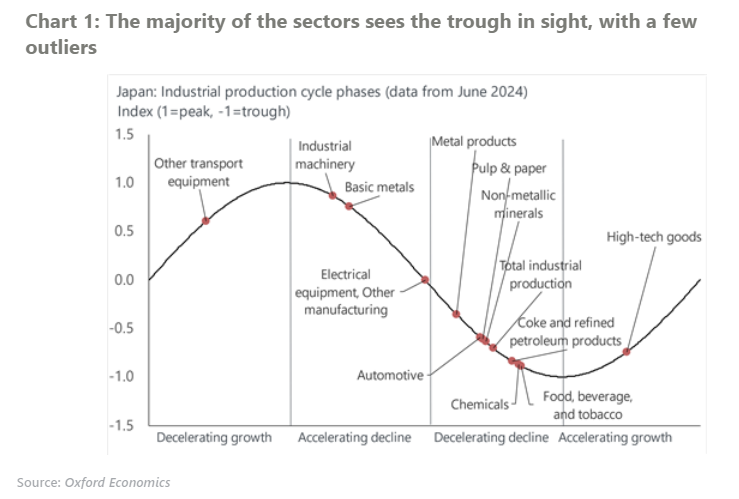

Our new proprietary business cycle phase indicator points to a trough in sight for industry, but with dispersion among sectors. High tech is leading the pack with output firmly on its way up. While most other sectors have yet to reach a cyclical trough, we believe they are now closing in.

What you will learn:

- Output of high-tech goods has been growing since the beginning of 2024 largely thanks to higher semiconductor production, notably bucking the downward trend across much of industry. We see momentum only strengthening from here, and at 4.1% growth for 2024, the industry is forecast to be one of the fastest-growing manufacturing sectors this year.

- Industrial machinery is on the other side of the spectrum, as it appears the slowdown since the end of 2022 is set to intensify. The softness is apparent across the board but is more pronounced in subsectors such as metal forming machinery, where a long inventory adjustment process appears inevitable.

- The auto sector’s position in the phase indicator is heavily distorted by the recurrent production stoppages stemming from the safety testing scandal. Absent these distortions, the sector would most likely be in the decelerating growth or accelerating decline phase.

- Chemicals have been declining since early 2022 due to higher energy prices but the turning point is close. The gradual appreciation of the yen will lower energy costs and support profit margins, although tighter monetary policy and the destocking cycle will keep growth in check.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More