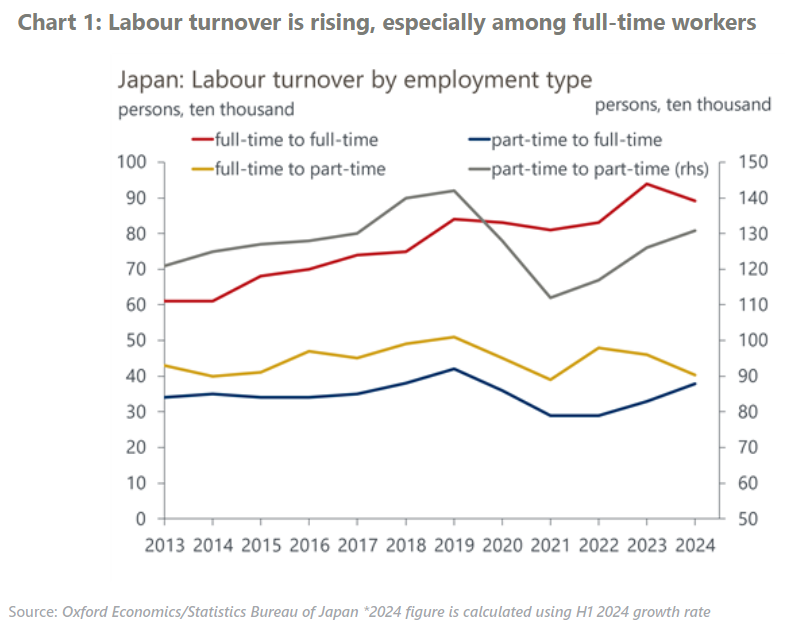

Japan’s rising labour turnover will raise productivity, but only slowly

Labour turnover is quickly rising among full-time workers in Japan, where long-term employment has been prevailing. Although a serious labour shortage and a sharp rise in labour turnover will provide a great opportunity and incentive for productivity improvement, we this this will occur only gradually.

What you will learn:

- Rising labour turnover, especially among young workers, has enhanced the ongoing wage-driven inflation process by changing the employment system in Japan, which has been characterized by the combination of long-term job security and a rigid seniority-based wage scale.

- Within same industries, employment has shifted from small firms to large firms. This change in the distribution of labour will likely accelerate as unprofitable small firms fail. The shift will raise productivity in those industries where the gap in productivity between large and small firms is significant.

- But progress in the reallocation of labour through turnover across industries has been limited. Changes in the share of labour input by industry have made only a modest positive contribution to overall productivity growth and its impact has become smaller in recent years.

- Labour turnover across industries will rise, but only gradually because it requires re-skilling of workers and the reallocation of workers across regions. Despite some positive impact from AI, we maintain a cautious projection of long-term productivity growth in Japan.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More