MENA: Key themes 2024 – The GCC will defy the global slowdown

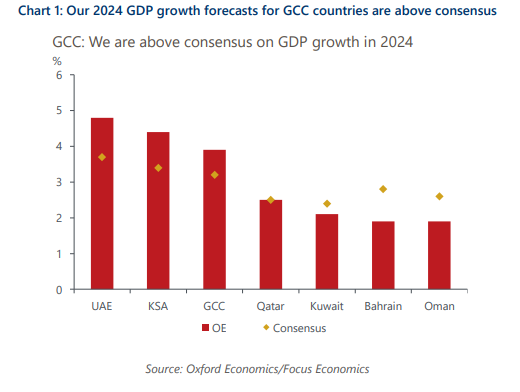

The Gulf Cooperation Council (GCC) region will expand less than we initially thought this year, but growth will improve in 2024 and outpace most advanced and emerging economies. There are four themes that shape our above-consensus 2024 GDP growth forecast for the GCC of 3.9%.

This research report expands on these key themes:

- Energy sector will see a slow turnaround. We expect regional producers to stick to oil supply curbs in the near-term, before unwinding them later in 2024. This will translate into a positive contribution to overall growth from the energy sector after a retreat this year.

- The non-energy economy will remain decoupled from global trends. Our key call for 2024 is that non-energy sectors drive overall growth with expansion of 4%. Government policies will underpin this resilience; we see a broadly stable fiscal outlook, and growth in off-budget spending in Saudi Arabia and the UAE. Meanwhile, GCC inflation will hover at a comparatively low level in a global context.

- Tourism and renewables will remain key diversification engines. We see steadfast investment in non-energy sectors, including tourism and renewables, as it is the essence of regional development visions.

- A widening of the Israel-Hamas war would upend 2024 outlook. Our optimistic view is vulnerable to a regional war escalation scenario through the prospect of disrupted oil supply, negative impact on investment and travel demand, and a deterioration in the global macro backdrop.

Tags:

Related Posts

Post

Is the outlook brightening for Saudi Arabia?

Last week, oil prices moderated by around 15%, as the ceasefire between Iran and Israel helped to reduce risk premiums.

Find Out More

Post

How Strait of Hormuz disruption could harm the economy

If the ceasefire negotiations between Israel and Iran break down, how likely is it that Iran will stop shipping through the Strait, and what would the impacts be?

Find Out More

Post

Impact of the Iran-Israel escalation on oil prices

Surging crude oil price from Iran-Israel conflict puts global GDP at risk. Is the world economy on the edge of another downturn?

Find Out More

Post

Can Saudi Arabia’s Non-Oil Momentum Drive Regional Growth?

Saudi Arabia's Q1 GDP was revised upward to 3.4% year-on-year, driven by a robust 4.9% expansion in the non-oil sector.

Find Out More