Beyond Compliance: Closing the Scope 3 Data Gap in Australia’s Food and Grocery Sector

Australia’s climate conversation is shifting. With a more ambitious 2035 target on the horizon, the focus is moving from whether companies should act on emissions to how quickly and strategically they can do it.

In the food and grocery sector – a $173 billion engine of the national economy – the challenge is clear: the sector’s vast, globalised supply chains mean most emissions occur far beyond the factory gate or shopfront. In fact, more than 70% of the sector’s carbon footprint sits in Scope 3 – indirect emissions from suppliers, transport and packaging, and product use. That’s an estimated 50 million tonnes of CO₂-e every year.

The visibility problem

Despite its scale, Scope 3 remains the least understood part of the footprint. Supplier data is patchy. Emissions factors are useful but generic. Forecasting is rare. Without a clear view, reporting becomes reactive and strategies are less informed.

This data gap is more than a compliance headache – it’s a barrier to competitive advantage. Companies that can see their Scope 3 profile clearly will move faster, set more credible targets, and make smarter investment choices. Those that can’t will play catch-up.

Connect with our team to discuss how closing your Scope 3 data gap can drive competitive advantage.

Get in touchAsking the right questions

Moving beyond compliance means shifting the conversation from “What do we have to disclose?” to “What will make the biggest difference to reduce emissions?” That means asking:

- How will our role in the value chain need to evolve over the next decade?

- Where in our supply chain can we achieve the highest impact per dollar spent?

- How do we measure up against the rest of the sector?

- Are our decarbonisation investments delivering measurable results?

Turning data into strategy

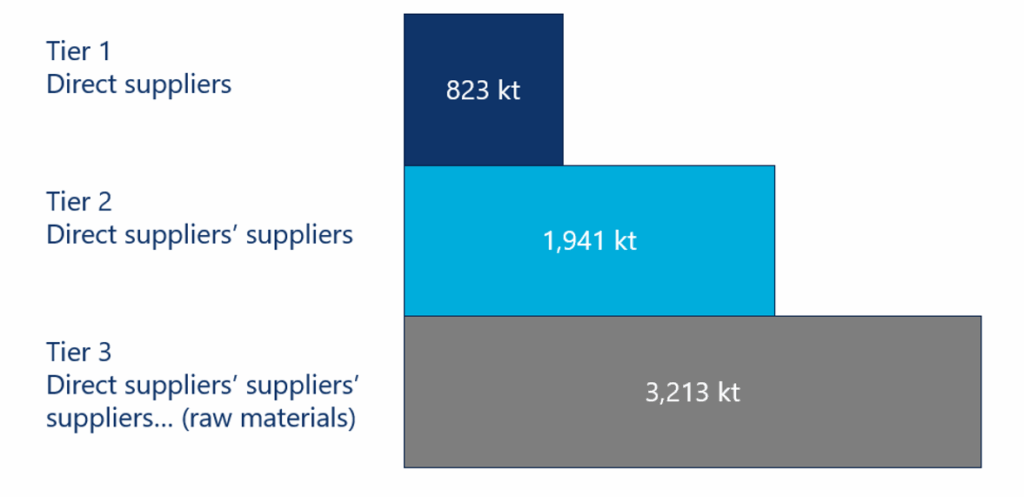

We can work with clients to inform these questions by combining their data with an environmentally enhanced global input-output model to bridge the gaps. By mapping procurement data against global emissions intensities, we can estimate impacts across Tier 1 suppliers, their suppliers (Tier 2), and even raw material extraction (Tier 3).

For example, our modelling shows that a typical Australian retailer with $18 billion in revenue generates nearly 6 million tonnes of Scope 3 emissions — with hotspots in utilities, basic metals, and packaging sourced from Australia and China. With that insight, leaders can focus engagement on the highest-impact suppliers, assess alternative sourcing locations, and model how changes in the global economy will shape their future footprint.

Estimated scope 3 emissions for an $18bn average Australian retailer

Managing an uncertain future

But we have to go beyond a snapshot view of emissions as they stand today. The world is changing rapidly and we need to consider our scope three emissions in light of future scenarios.

Fortunately, the Australian Sustainability Reporting Standards require companies to develop quantified climate scenarios. Combining these scenarios with your scope 3 analysis provides the information base for a well-informed assessment of your organisation’s role in the value chain today, and in the future.

From a practical perspective, this information will enable you to better communicate the assumptions underpinning your scope 3 targets. Specifically, we’ve noticed that a lot of corporates target net zero scope 3 emissions by 2050 – but that assumes a net zero world by 2050. The reality is messier: emissions are still rising globally, Australia has made little progress since COVID, and a number of countries – including China – that form an essential part in our globally integrated supply chains aren’t targeting net zero until 2060.

Targeting net zero is essential for our future well-being – but a robust climate disclosure and climate transition action plan needs to carefully outline the assumptions underpinning scope 3 emissions given we rely on progress well beyond our borders to get there.

A practical starting point

The good news? You don’t need perfect data to act.

- Start with your procurement records.

- Use IO-based tools to fill the gaps.

- Layer in climate scenarios to understand your exposure over time.

- Identify and prioritise your emissions “hotspots.”

- Track, review, and adapt as the world – and your supply chain – evolves.

Scope 3 is complex, but it’s also the biggest opportunity. By closing the data gap, food and grocery businesses can move beyond compliance, build resilience, and play a decisive role in Australia’s low-carbon transition.

Related content

Unlocking Economic Growth in Regional Australia Through Digital Delivery

Oxford Economics Australia delivered an independent economic impact assessment for Uber Eats, quantifying additional revenue for restaurants, GDP contribution, and consumer wellbeing benefits across 67 new regional markets.

Find Out More

Demonstrating Babcock’s Value to Australia’s Economy and National Resilience

Oxford Economics Australia provided Babcock with a comprehensive, independent analysis quantifying its total GDP, employment, tax, and socio-economic contributions across Defence and Civil sectors, SME engagement, and state-specific impact modelling.

Find Out More

Informing Strategic Planning Amid Tariff Uncertainty for Canadian Municipalities

Discover how rising tariffs are impacting Ontario municipalities' construction costs. Learn about budget pressures and strategies for effective planning.

Find Out More

Oxford Economics’ WACC Methodology Informs Australia’s Green Energy Transition

Uncover the critical role of investment analysis in Australia's energy sector. Gain insights into cost of capital benchmarks for evaluating diverse energy projects.

Find Out MoreTags: