Blog | 27 Jul 2021

Policy-makers bet on construction to escape COVID economic shock

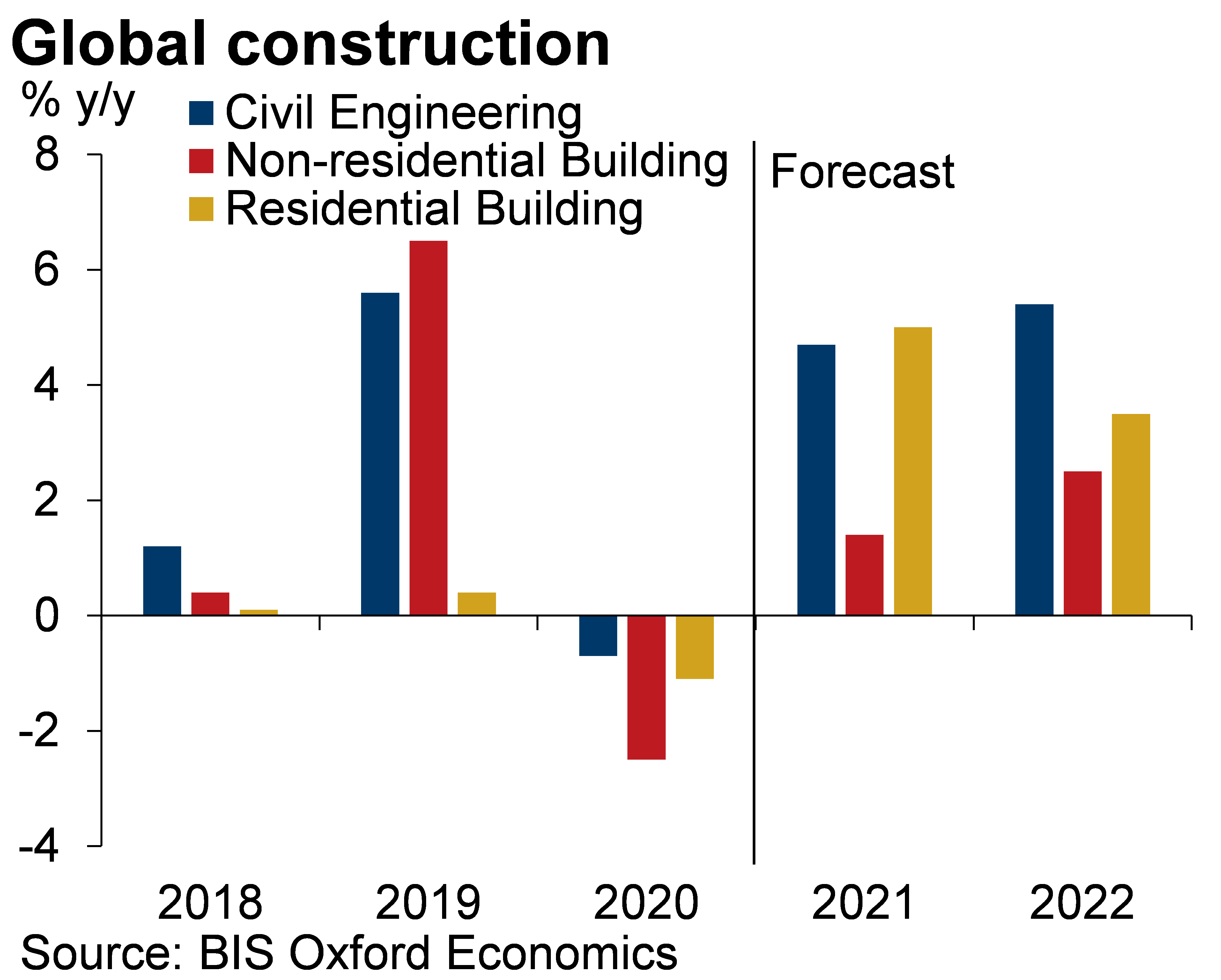

The construction sector did not escape the coronavirus-induced economic downdraft unscathed. Activity at the global scale fell 1.4% in 2020, with much steeper declines in countries that imposed harsher restrictions. But things are changing.

Loose monetary policy and targeted fiscal policy mean global construction activity is set to rebound; we expect work done to rebound 3.9% in 2021. Activity is expected to rise across the board, but it’s the wave of incoming public stimulus, largely funnelled through infrastructure projects, that will cause the biggest splash. Governments opting to fast-track major infrastructure projects is a standard play, with the short-term win from stronger demand followed by long-term gains to the economy’s supply side. And we don’t expect this time to be any different.

In the US, the American Jobs (AJP) Act will be the main package used by the government. We expect the act to pass Congress following an agreement between a group of bipartisan senators, which will result in US$579bn of spending over the next decade. It will focus on green solutions through investing in new public transportation infrastructure, connecting cities via high-speed rail and building new mass transit systems within urban centres. Following a near-term mini-boom in residential activity, driven by ultra-low interest rates and a shift in preferences towards detached housing, government stimulus will pick up the reins from 2022.

In the US, the American Jobs (AJP) Act will be the main package used by the government. We expect the act to pass Congress following an agreement between a group of bipartisan senators, which will result in US$579bn of spending over the next decade. It will focus on green solutions through investing in new public transportation infrastructure, connecting cities via high-speed rail and building new mass transit systems within urban centres. Following a near-term mini-boom in residential activity, driven by ultra-low interest rates and a shift in preferences towards detached housing, government stimulus will pick up the reins from 2022.

Across the European Union, government spending to help restart economies is expected to drive strong levels of publicly funded building activity. Activity will also be supported by the €723bn Recovery and Resilience Facility (RRF), which is part of the €806bn Next Generation EU (NGEU) fund. Although big electricity generation projects can steal the headlines, the NGEU will focus on making buildings more energy efficient and incentivise less carbon-intensive transport via changes in national and urban infrastructure. The sector will also find key support from a push towards green energy generation and energy security, with a number of large wind and solar projects, and also nuclear powerplants, in the pipeline.

Investment in major civil engineering projects in Asia is set to drive growth in construction activity over the coming years. Governments in the region are focused on pushing ahead with a large backlog of key transportation projects, with regulatory changes to speed up approval processes. Schemes such as Hong Kong’s $US25bn strategic infrastructure plan, the “Build, Build, Build” program in the Philippines and Indonesia’s Presidential Regulation No. 109 of 2020 will provide vital support to the sector.

In Australia, a strong pipeline of major publicly funded transportation projects will also support construction activity over the coming years. This boom will be strongest along the eastern coast, supported by major road and railway projects including metro lines in Australia’s four largest cities. Government support via HomeBuilder and other state stimulus measures, will also help turbocharge residential construction in the near term.

Tags:

You may be interested in

Post

The Construction Productivity Challenge in Australia

Delve into the state of construction productivity in Australia. Understand the factors affecting growth and how innovation can transform the industry for the better.

Find Out More

Post

The Next Chapter for Rail: From Megaprojects to Maintenance and Skills

Blog Policy-makers bet on construction to escape COVID economic shock Preparing Australia’s Rail Workforce for a Future Beyond Construction The infrastructure investment boom has dramatically transformed Australia’s rail sector. Over the past decade, we’ve seen extraordinary progress-from expanding metro networks to constructing major freight and regional rail projects. As I shared during my keynote at…

Find Out More

Post

European defence spending surge: which sectors will benefit?

Our modelling suggests the main beneficiaries of the spending will be a highly concentrated subset of capital-intensive subsectors, mainly in transport and electronics.

Find Out More