Productive sectors remain onshore in Japan amid declining workforces

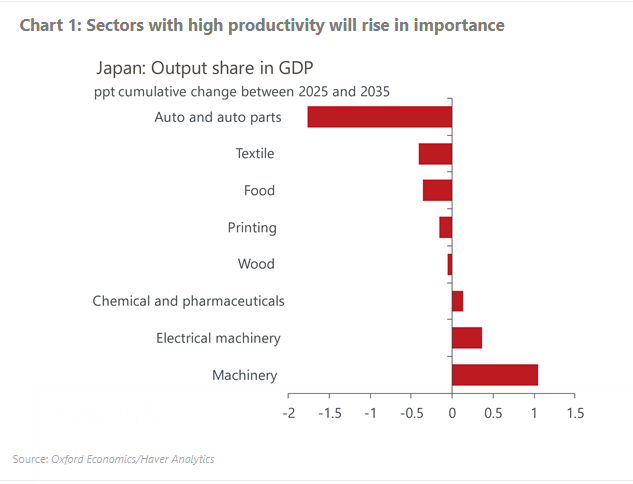

Amid the continued decline in working-age population, we expect Japan’s knowledge-intensive manufacturing sectors will likely outperform other sectors. Machinery, automotive, and chemicals all require specialised know-how that are not easily replicable, and these sectors are striving to boost labour productivity through various forms of investment. The machinery sector will perform particularly well, with its share of manufacturing rising more than 1 ppt by 2035.

The three sectors have remained resilient over decades, even when emerging markets such as China boosted manufacturing capacity by taking advantage of cheap labour. They coped by offshoring production while boosting domestic labour productivity.

These sectors have done so by either investing into capital or improving production efficiency through software investment and R&D spending, and they will continue to benefit from their existing capital stock and accumulated know-how. A low reliance on labour makes it easier to sustain production even amid a shrinking labour force, and high productivity generally leads to higher wages, helping them attract workers.

As labour shifts to more productive sectors, economy-wide productivity will also rise, but not without challenges. External factors like tariffs and the EV transition, where Japanese automakers fall behind, will weigh on the auto sector. Moreover, labour market frictions, such as tight regulations and the cost of reskilling, could hamper labour movement across sectors.