Property sector risks haven’t gone away

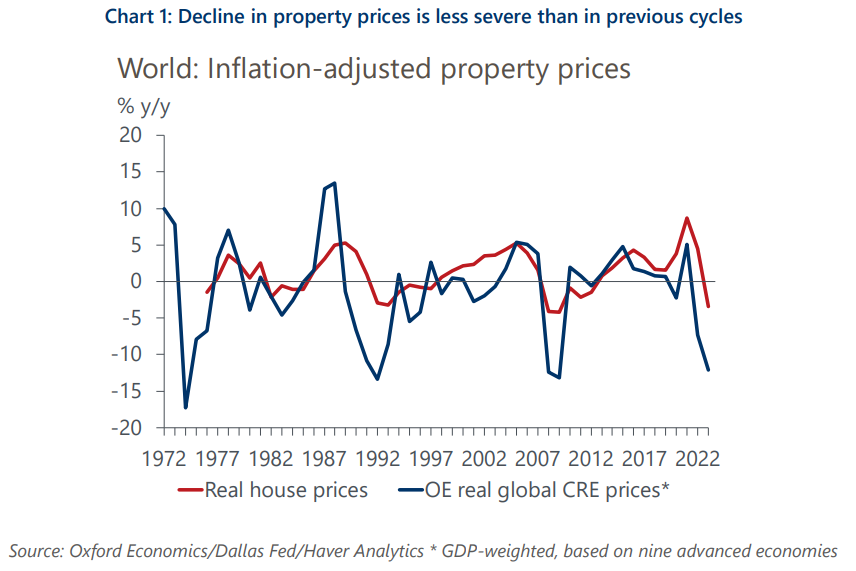

Overall, the downturn in the property sector is much less severe than in some previous cycles, especially for residential property. This is good news for growth. Still, property sector risks haven’t gone away yet, especially in the troubled commercial real estate (CRE) area.

What you will learn:

- Global real house prices fell 3.4% last year, which compares to double-digit falls in the previous two downturns. CRE prices, however, fell 19% in real terms from 2022-2023 which is starting to look comparable to the 25% falls in the early 70s, early 90s, and the global financial crisis.

- The decline in residential construction so far in advanced economies also compares favourably to previous cycles and overall construction has been boosted by unusual strength in non-residential structures. Meanwhile, CRE investment has slumped badly.

- Leading indicators like mortgage approvals and construction orders are still weak, especially in Germany. Distress indicators like mortgage arrears are also low, but it looks likely that in the near term, real house prices will flatline or decline slowly and housing construction stay subdued.

- The biggest risks are concentrated in the CRE sector. The decline in prices looks quite rapid historically and recent news has featured stories of large CRE sector write downs in the office sector.

Tags:

Related Posts

Post

Downside risks for Asian industrial real estate markets

The 'liberation day' tariffs have been postponed, but the existing tariffs and those likely forthcoming present significant downside risks for most Asian industrial real estate markets. Reduced business investment, weaker confidence, and risk-off sentiment alone will inflict a demand shock on industrial and logistics operators, with expansion plans likely on hold.

Find Out More

Post

Real Estate Key Themes 2025: A tentative revival for CRE growth

After a year of transition in the commercial real estate cycle in 2024, we believe CRE is poised for a tentative revival in values.

Find Out More