Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

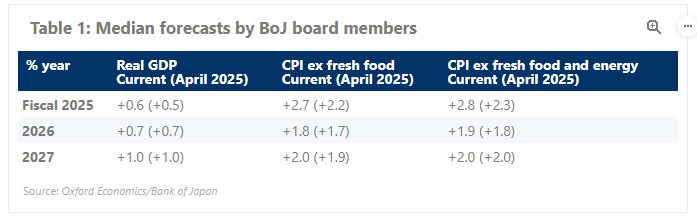

Reflecting recent price developments, the BoJ upgraded its inflation projection for FY 2025 but kept its view that inflation will be lower in FY2026. The BoJ continues to expect sluggish growth over FY2025/26 amid weak external demands.

However, we don’t think the higher inflation outlook increases the chances of a rate hike soon. Elevated inflation recently is mostly driven by food prices, especially rice, which reflect prior high input costs. In fact, the food industry’s pricing powers are diminishing, and we anticipate food inflation easing in 2026 as input costs fall, bringing the overall CPI below 2%.

Instead, we expect the BoJ will take a long break before hiking again, at least until the initial tariff shocks abate next year. Consumers are increasingly feeling the strain from high food prices. Though we expect gradual gains in real incomes will support consumption ahead, fading confidence will limit the recovery in the near-term.