Recent Release | 27 Jul 2023

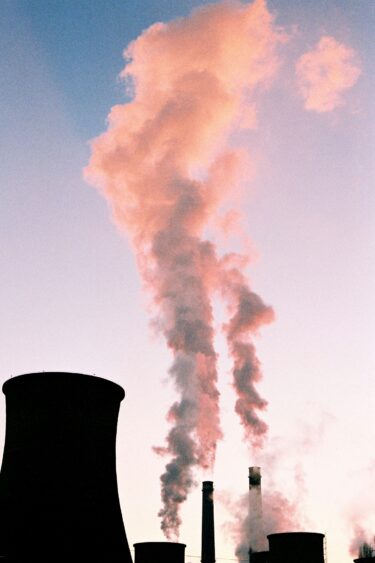

The Clean Growth Gap: How low carbon energy investment can transform the UK

Industry Consulting Team

Oxford Economics

This report sponsored by Energy UK investigates the challenges the UK faces in attracting sufficient private sector investment to finance its clean energy transition. It also details the economic benefits that transition could bring.

In order for the UK to meet its Net Zero goals, private sector investment in a decarbonised power system is essential. However, there is a risk that incentive schemes around the world such as the US Inflation Reduction Act will attract investment in green energy infrastructure away from the UK. This would cause the UK to fall behind in the global race to decarbonise. Oxford Economics’ forecasts already predict the UK will have the slowest growth in low-carbon electricity generation between now and 2030 of the world’s largest eight economies.

A slowdown in private sector investment would suppress the UK’s flourishing clean energy industry which is estimated to employ 247,400 full-time equivalent (FTE) workers. The UK clean energy sector also supports many other workers indirectly both through purchase from its domestic supply chain and the wages spent by people working in the sector. Oxford Economics’ modelling suggests that manufacturing sectors would be amongst the biggest beneficiaries of increased green investment spending. These manufacturing sectors are often situated in areas whose fortunes have declined in recent years due to deindustrialisation. As such, there is a risk that a lack of investment in the UK’s clean energy industry would also lead to opportunities to reduce geographical disparities being missed.

The UK stands at a cross road. To establish itself as a global leader in clean technologies, the paper argues it will require decisive action from government as well as effective working between government, industry, and civil society.

The experts behind the research

Our Industry Consulting team are among the world’s leading analysts of a variety of industrial sectors. They combine their expert insight with our state-of-the-art economic models and tools to answer the crucial questions facing our clients.

Emily Gladstone

Senior Economist, Industry

Andy Logan

Director of Industry Consulting

Tags:

You may also be interested in

The Green Leap – Project bankability takes centre stage

The report argues that enhancing project bankability should become a main policy priority as part of climate investment endeavors.

Find Out More

What does the critical minerals boom mean for Africa? | Greenomics podcast

As demand grows for critical minerals like cobalt, copper, and lithium, African nations are navigating opportunities and risks—from boosting local employment to managing geopolitical tensions and environmental concerns.

Find Out More

Toward a global carbon pricing system

Fragmented carbon markets and the risk of carbon leakage are jeopardizing progress toward global net-zero targets. A major challenge lies in the lack of coordinated policies to align around a unified carbon price. Oxford Economics, in a study for the Hinrich Foundation, highlights how regional carbon markets could offer a practical path toward more effective global pricing.

Find Out More

Trump 2.0: US climate policy in retreat

From executive orders to federal lawsuits against state-level climate policies, the Trump administration has acted with urgency to reverse the low-carbon momentum built under President Biden.

Find Out More