The enduring appeal of US Treasuries to Japan’s investors

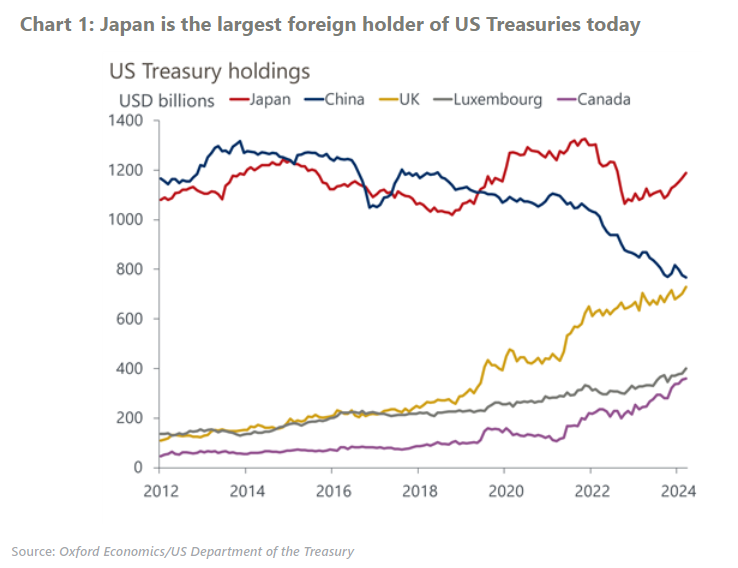

Some market participants are raising concerns over a fall in demand for US Treasuries from Japanese investors amid higher domestic yields. But we think that there will continue to be a large and stable investor base in Japan for US Treasuries due to the still-large yield gap. Also, uncertainty over the Bank of Japan’s monetary policy is dissuading investors from increasing their holdings of Japanese government bonds.

What you will learn:

- After a sharp drop in Japan’s US Treasuries holdings in 2022 as US yields rose, commercial banks restored their foreign bond portfolios in 2023. Pension funds have also maintained steady purchases in foreign bonds following their mid-term asset allocation. Life insurers are the only group to have continued to reduce foreign bond holdings as hedging costs have been elevated.

- We expect Japanese investors will increase their US Treasuries holdings gradually, following a turn in bond market trends and backed by persistent yen weakness. Even life insurers will likely resume their investments in US Treasuries without FX hedges probably in Q4 2024, while steering away from hedged bonds.

- We don’t think Japanese investors will shift their portfolio allocations to domestic assets any time soon, notwithstanding the recent pick-up in domestic yields. The expected total return of JGBs is still considerably lower than US Treasuries in yen terms. For lifer insurers in particular, the current 30-year JGB yield level is only slightly above average procurement interest rates of around 2%. In addition, expectations of a continued rise in yields fuelled by uncertainty in Japan’s monetary policy over the mid-term is precluding a swift return to JGBs by domestic investors.

Tags:

Related Posts

Post

Tariffs and Politics Leave the BoJ Powerless in Japan

The Bank of Japan kept its policy rate at 0.5% at its July meeting. We continue to think the BoJ will exercise caution on rate hikes despite still-high inflation and a recent trade deal with the US.

Find Out More

Post

US-Japan Trade Deal Fails to Shift Japan’s Growth Outlook

We estimate that the US's effective tariff rate on Japanese products is around 17%, in line with our baseline assumption. Lower tariffs on autos are a positive, given the sector's significant contribution to the economy and its broad domestic supporting base

Find Out More

Post

Japan’s Rising Political Instability Will Undermine Fiscal Discipline

The ruling Liberal Democratic party (LDP) and its partner Komeito lost their majority in Japan's upper house elections on July 20. Although Prime Minister Shigeru Ishiba will likely stay to avoid political gridlock, especially to complete tariff negotiations with the US, the political situation has become fluid and could lead to a leadership change or the reshuffling of the coalition.

Find Out More