The Environmental Impact of Digital Over Cash Payments in Europe

Commissioned by European Digital Payments Industry Alliance

On behalf of the European Digital Payment Industry Alliance (EDPIA), our report on “The Environmental Impact of Digital over Cash Payments in Europe” seeks to evaluate carbon emissions across payment systems at point of sales.

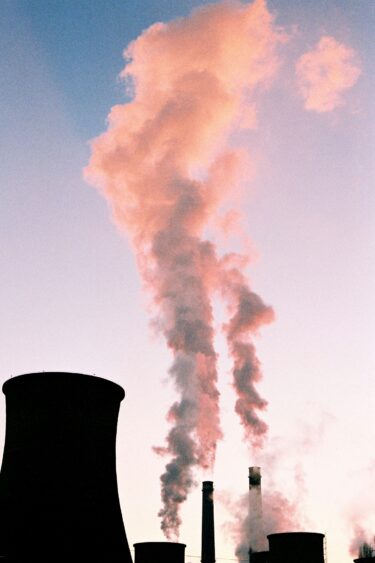

Businesses and governments are becoming more and more focused on mitigating the effects of climate change through processes and policies, and the payment sector is no exception. As digital payments become more prevalent—with the number of non-cash payments doubling from 21% in 2016 to 41% in 2022 in the euro-area alone according to the European Central Bank—there has been a growing need to understand the environmental effects of these shifting preferences. Although some evidence indicates that digital payments have a smaller environmental footprint than cash payments, there has not been a comparative lifecycle assessment done between the two of them. In addition, given large differences across geographies, the actual impacts of payment methods at points of sales (POS) can differ widely from country to country.

To examine this issue, this study utilises a Life-Cycle Assessment (LCA) following the International Organization for Standardization (ISO) guidelines. A method Oxford Economics has added to its toolkit, the LCA is a holistic approach that appraises environmental impacts across stages of a product lifecycle on a variety of categories. Which, in this case, includes a total of different 18 categories including for example, global warming potential, mineral resource scarcity, and ionizing radiation. This cradle-to-grave approach is used for three purposes:

- Firstly, to consider the separate processes of cash and non-cash payments in order to isolate the environmental “hotspots” and their respective impacts.

- Secondly, to understand the processes in three countries with different rates of payment adoption—Italy, Germany, and Finland—for comprehensive results.

- Thirdly, to compare the environmental impact of cash and non-cash payments at point of sales in the different impact categories.

To download the report that has been approved by an expert panel review, please click the button below.

The experts behind the research

Our Economic Consulting team are world leaders in quantitative economic analysis, working with clients around the globe and across sectors to build models, forecast markets and evaluate interventions using state-of-the art techniques. The lead consultants on this project were:

Jan Sun

Senior Economist

Hannah Zick

Economist

Johanna Neuhoff

Associate Director Of Consulting

Tags:

Recent related reports

The Green Leap – Project bankability takes centre stage

The report argues that enhancing project bankability should become a main policy priority as part of climate investment endeavors.

Find Out More

What does the critical minerals boom mean for Africa? | Greenomics podcast

As demand grows for critical minerals like cobalt, copper, and lithium, African nations are navigating opportunities and risks—from boosting local employment to managing geopolitical tensions and environmental concerns.

Find Out More

Toward a global carbon pricing system

Fragmented carbon markets and the risk of carbon leakage are jeopardizing progress toward global net-zero targets. A major challenge lies in the lack of coordinated policies to align around a unified carbon price. Oxford Economics, in a study for the Hinrich Foundation, highlights how regional carbon markets could offer a practical path toward more effective global pricing.

Find Out More

Trump 2.0: US climate policy in retreat

From executive orders to federal lawsuits against state-level climate policies, the Trump administration has acted with urgency to reverse the low-carbon momentum built under President Biden.

Find Out More