Research Briefing

| Sep 16, 2022

The terminal policy rate is in sight for India

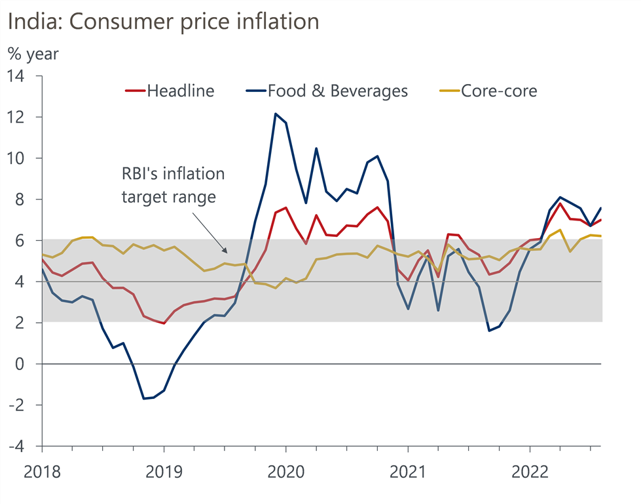

Recent developments strengthen our view that India’s inflation has passed its peak. The steep rise in headline CPI that began in late 2021 was largely driven by imported inflation due to supply chain issues and sky rocketing commodity prices following Russia’s invasion of Ukraine. These pressures are now retreating.

What you will learn:

- We expect the Reserve Bank of India (RBI) will hike another 35bps-50bps at its meeting this month. We think the bounce back in India’s CPI to 7% in August and a hawkish US Federal Reserve justify the move.

- However, beyond that, easing supply bottlenecks and a much weaker growth outlook have diluted the case for further aggressive tightening. We expect the RBI to deliver a final 25bps hike in Q4 and then pause for most of 2023.

- We expect CPI inflation to gap lower from Q2-2023 after having hovered around 7% for a short period. This reflects our view of quicker easing of supply constraints and external price pressures next year, facilitated by weakening demand.

Tags:

Related posts

Post

New Rules of Engagement: The Strategic Rise of Government Affairs in Asia

What’s behind Asia’s new era of policy assertiveness? What does it mean for international firms?

Find Out More

Post

Trump tariffs to shake up Asian manufacturing in 2025

The new US tariffs add an additional layer of drag on Asian manufacturing activities. India will be one of the least affected countries.

Find Out More[autopilot_shortcode]