Research Briefing

| Sep 4, 2024

What to Expect for Equities When the Fed Cuts Interest Rates

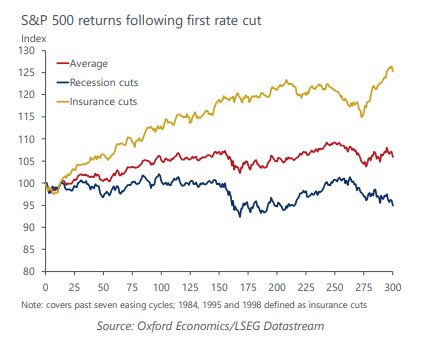

The onset of the Federal Reserve’s easing cycle is typically positive for equities so long as the US economy avoids a recession. We expect this to be the case in the current cycle, although upside for equities is likely to be tempered by high aggregate valuations and slowing EPS growth.

What you will learn:

- We think rate cuts will help to support an ongoing broadening of performance. Cyclical sectors are likely to fare well as activity proves relatively resilient and small cap stocks should benefit as balance sheet pressures ease.

Tags:

Related Reports

Click here to subscribe to our asset management newsletter and get reports delivered directly to your mailbox

Why bond yields are rising again and why it matters

The rise in bond yields reflects fiscal concerns, higher risk premia, shifting investor preferences, and idiosyncratic factors.

Read more: Why bond yields are rising again and why it matters

Indirect climate risk in financial analysis

Climate and other sustainability challenges can affect the finance sector and have a material impact on returns to capital.

Read more: Indirect climate risk in financial analysis

Strategy Key Themes 2025: Opportunities amid heightened uncertainty

We think the environment of strong US demand coupled with still ample global liquidity, should be positive for US risk assets.

Read more: Strategy Key Themes 2025: Opportunities amid heightened uncertainty

Economics for Asset Managers

Read more of our analysis and reports on asset management and economic outlook.

Read more: Economics for Asset Managers[autopilot_shortcode]