What would be the implications of tariffs on Chinese EVs?

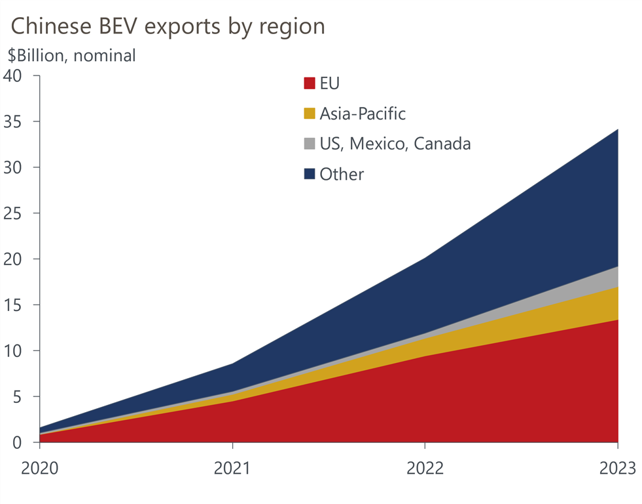

Announced tariff increases by the US and EU on made-in-China EVs, if implemented, will increase EV prices and reduce demand. This will slow the adoption of EVs globally, to the detriment of the energy transition.

What you will learn:

- The US tariffs—to be raised from 25% to 100% in August—are prohibitively high and will discourage inflows of cost-competitive Chinese EVs that would lower prices for US consumers.

- The EU tariffs range from 27.4% to 48.1% and have been applied on a firm-specific basis, though they are provisional and could be scrapped following EU-China negotiations. Many local Chinese brands earn significant profits on their EU sales and have the capacity to absorb the tariffs. In these cases, prices will likely increase, but not substantially. But for foreign brands using China as a manufacturing hub for export to the EU, the tariffs are likely to significantly erode profitability.

- Retaliatory measures by the Chinese government are set to be defensive in nature and focus on mild targeted tariffs and currency offsets.

- Our Q3 Global Industry Service forecast update, being released in early September, will include the expected impacts of the tariffs on EV sales and production regionally and globally. You may request a trial of our service here.

Tags:

Related Resources

Post

Understanding Australia’s Goods Trade Dynamics in 2025

2. Explore Australia's goods trade dynamics, with rising exports and falling imports. Learn how global demand impacts the trade balance and future projections.

Find Out More

Post

The Future of Trade: Tariffs, Taxes, and Economic Trends

Amid ongoing global trade uncertainty, business leaders are struggling to plan ahead as new tariffs continue to reshape the market. Even so-called “locked-in” tariffs are proving to be temporary, adding to the unpredictability. Firms are cautious, waiting for clarity before committing to major investments. As global trade volumes decline, the importance of understanding every relevant trade tariff and accurately applying the correct HS code to imported goods becomes even more critical for managing costs and compliance.

Find Out More

Post

Fresh tariffs redraw trade map

Trump’s latest tariffs favour Australia and Singapore with unchanged 10% rates, while Brazil faces a sharp 50% hike. India, Vietnam, and Bangladesh continue to face some of the world’s highest effective tariffs despite recent declines.

Find Out More