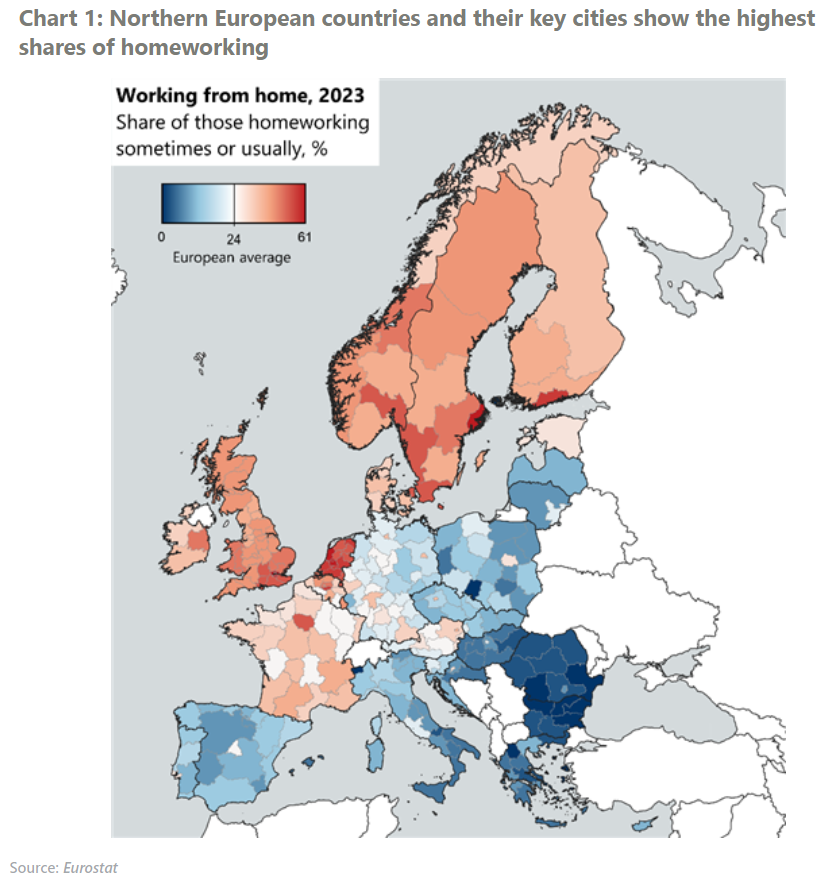

Working from home is most prevalent in northern European cities

Working from home looks to be entrenched in Europe. After peaking in 2021 during the Covid-19 pandemic and dropping slightly in 2022, the percentage of those working from home did not change in 2023. But there is much variation both across and within European countries, with the UK, Netherlands, and the Nordics seeing the highest shares of homeworking. Hybrid working has already had a big impact on office markets, and combining homeworking trends with our forecasts for office-based employment can give insights into future office demand.

What you will learn:

- Among major cities, London, Stockholm, and Amsterdam reported the highest shares of residents working from home in 2023, with Paris not far behind in sixth place. At the other end of the spectrum, cities with sizeable manufacturing or hospitality sectors, such as Athens, Barcelona, and Milan, had lower shares of homeworking. There was also a reduced tendency to work from home in CEE cities, with Sofia and Bucharest at the bottom of our ranking of major cities.

- Supplementing our analysis with high-frequency public transport use data, we find no significant pick-up in 2024 for London, Paris, nor Berlin. This points to homeworking prevailing in these cities this year, which is likely indicative of broader European trends.

- Over the next five years, office demand in Madrid, Barcelona, and Bucharest will likely benefit from a combination of stronger forecast growth in office-based employment and lower shares of homeworking. Whereas below-average forecast growth for office-based employment in Amsterdam, Paris, and Brussels, combined with their high homeworking propensities, will likely result in more muted demand for office space.

Tags:

Related Reports

Click here to subscribe to our real estate economics newsletter and get reports delivered directly to your mailbox

Office rents entering growth cycle in Australia

Housing policy outlook clears after Federal Election in Australia

New indices offer insights into real estate sentiment

Real Estate Trends and Insights

Read more analysis on real estate performance and location decision-making.

Read more: Real Estate Trends and Insights